Hyderabad’s Growing Commercial Leasing Market

Hyderabad is no longer just an emerging market, it has firmly established itself as one of India’s most dynamic commercial leasing hubs. With multinational corporations (MNCs) making large-scale investments, the city is witnessing record-breaking office space absorption, infrastructure expansion, and increasing real estate returns on investment (ROI).

As Hyderabad cements its position as a key player in India’s commercial real estate landscape, its impact extends beyond leasing numbers. It’s shaping the future of business expansion in India.

Key Drivers of Growth

- Competitive Leasing Costs: Hyderabad offers premium office spaces at 30-40% lower costs than Mumbai and Bengaluru.

- Infrastructure Growth: Expansion of the Outer Ring Road (ORR), Metro Rail, and Financial District has fueled commercial demand.

- IT & GCC Expansion: Hyderabad leads in Global Capability Center (GCC) absorption, with record leasing of 5.5 million sq. ft. in 2024.

- Business-Friendly Policies: Telangana’s TS-iPASS policy and single-window clearance have streamlined approvals for businesses.

Tracking the Growth Trajectory

GCC Growth: Hyderabad’s Rise as a Global Business Hub

- 30% of new GCCs in India over the last five years have chosen Telangana as their base.

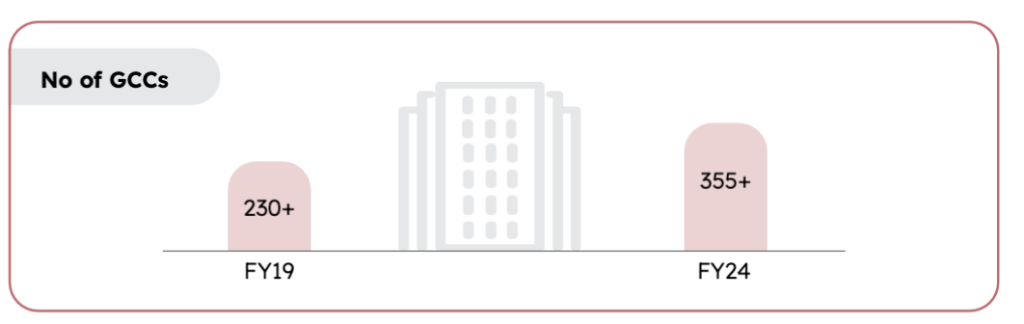

- In FY19, Hyderabad had 230+ GCCs, which has surged to 355+ by FY24, marking a 54% growth.

- Hyderabad is set to add 4-6 million sq. ft. of new office space over the next 3-5 years, specifically targeting the growing demand from Global Capability Centers (GCCs) across sectors.

- Major companies like JP Morgan, Wells Fargo, Goldman Sachs, and DBS Bank have expanded their global operations in Hyderabad.

Expanding Office Space Inventory

- Hyderabad’s commercial office space (CBD & Non-CBD) now spans ~75-80 million sq. ft., driven by IT, GCCs, and tech firms.

- In 2024, it saw a 17% year-on-year (YoY) increase in commercial real estate transactions, reflecting rising corporate demand.

- 15.6 million sq. ft. of new office space added, marking a 139% growth—the highest among major metro cities.

- Hyderabad’s total office stock is projected to exceed 200 million sq ft by 2030.

New major office leasing

| S.no. | Name of Company | Space leased(sqft) |

| 1 | 3 Million | |

| 2 | Microsoft | 1.1 Million |

| 3 | Cognizant. | 1 Million |

| 4 | Qualcomm | 4,14,000 |

| 5 | HCL Tech | 3,20,000 |

| 6 | Amegen | 2,65,881 |

| 7 | Apple India | 2,50,000 |

| 8 | LTIMindtree | 1,09,000 |

| 9 | IBM | 1,06,000 |

Rental Appreciation

Office rental rates in Hyderabad grew by 7%, driven by strong demand for Grade-A office spaces.

Impact on Real Estate ROI and City Growth

The rise in commercial leasing has positively impacted the residential sector, particularly in strategic micro-markets such as Gachibowli, HITEC City, and Kokapet. Increasing employment opportunities and higher disposable incomes have fuelled demand for both mid-segment and luxury housing.

Boost in Residential Market

The rise in commercial leasing has positively impacted the residential sector, particularly in strategic micro-markets such as Gachibowli, HITEC City, and Kokapet. Increasing employment opportunities and higher disposable incomes have fueled demand for both mid-segment and luxury housing.

- Strong Sales Growth: Hyderabad recorded a 12% increase in total housing sales, the highest among Indian metro cities.

- Surge in High-Value Home Sales: Properties in the ₹1-2 crore segment grew from 38% to 46%, while the ₹2-5 crore segment increased from 11% to 13%, reflecting a shift toward premium housing.

- Consistent Price Appreciation: Residential property prices rose 8% YoY in 2024, reinforcing Hyderabad’s position as a lucrative real estate market for luxury investors.

Enhanced ROI for Investors

Rental rates surged 25.6% YoY, one of the highest increases among metro cities, ensuring steady income for property investors.

Hyderabad growth

- Economic Development and Job Creation: The expansion of IT hubs, GCCs, and startups is creating thousands of jobs, attracting top talent and boosting the local economy.

- Increased Business Investments: Major MNCs and financial institutions are expanding operations, fueling corporate investments and economic growth.

- Infrastructure & Urban Expansion: Rapid development of IT corridors, metro connectivity, and business districts is enhancing livability and supporting long-term city growth.

Unveil the 50-50 payment plan

Also Check out ASBL Loft, ASBL Spectra, ASBL Landmark

Conclusion

Hyderabad’s ascent as a commercial leasing powerhouse is a testament to its strategic advantages and proactive government policies. The city’s ability to attract and retain MNCs, coupled with a robust talent pool and modern infrastructure, is driving consistent growth in office leasing activity. The ripple effect on residential markets and the city’s economic development positions Hyderabad as one of India’s most promising real estate markets in the coming years. For investors, developers, and businesses, Hyderabad presents a compelling growth opportunity with strong long-term returns.

FAQs

Yes, with consistent demand, rental growth, and increasing FDI, Hyderabad’s commercial real estate market offers strong ROI potential for institutional and private investors.

Rental values in key business hubs like HITEC City and Financial District increased by 25% compared to pre-pandemic levels, with further appreciation expected.

Hyderabad offers competitive rents, a large skilled workforce, and a pro-business environment, making it an attractive destination for MNCs.