Is Now the Right Time to Buy Home in Hyderabad? Inflation’s Impact Explained

Introduction

Hyderabad, the bustling city known for its rich cultural heritage and rapid urbanisation has experienced a significant impact of inflation on various sectors, notably the real estate market. The phenomenon of inflation has had a general increase in prices of goods and services and can have multifaceted implications on the process to buy home in Hyderabad. Understanding the nuanced effects of inflation on the real estate landscape is crucial for prospective homebuyers navigating this dynamic market.

Understanding Inflation’s influence on Hyderabad Real Estate

Inflation in Real Estate: Impact Analysis on Property Prices in Hyderabad

The city of Hyderabad has been witnessing a dynamic shift in its real estate landscape, largely influenced by the ever changing economic factors, notably inflation. An in depth analysis of how inflation affects property prices in Hyderabad is required in order to plan according to one’s ambitions in partaking in Hyderabad’s Real Estate properties, by examining the trends, factors and implications of inflation on the real estate sector, we’ll explore the nuances that contribute to the fluctuating property rates in the city.

- Rising Property Costs: Inflationary pressures often lead to an increase in construction material prices, labor costs and land values. This escalation in costs directly impacts property rates in Hyderabad, causing them to rise over time.

- Interest Rates and Affordability: Inflation can influence lending rates set by financial institutions. When inflation rises, central banks might increase interest rates to control it. Higher interest rates can make home loans more expensive thus affecting the affordability of properties for potential buyers.

- Demand Supply Dynamics: Inflation can disrupt the balance between property demand and supply. When inflation is high, property developers might slow down new projects due to increased costs hence leading to limited supply. This scarcity can drive property prices upwards, especially in popular or developing areas of Hyderabad.

- Investment Perspective: Inflation can impact the investment appeal of real estate. Some investors view property as a hedge against inflation, as real estate values historically tend to increase over time. However, rapid inflation might also lead to speculative bubbles that impact property prices unpredictably.

- Government Policies and Regulations: Economic policies aimed at controlling inflation such as changes in taxation or regulations can have ripple effects on the real estate sector. This includes policies related to land acquisition, property taxes or incentives for affordable housing, influencing property rates in Hyderabad.

Hyderabad Real Estate Trends: Insights from Property Advisors and Advisors on Property Prices in Hyderabad

Taking examples to study the current trends in Hyderabad’s Real Estate market can help to understand and learn the dynamic shift from area to area. One such example would be Kukatpally, a prominent residential and commercial locality in Hyderabad currently witnessing substantial growth and development in its real estate sector. The property market in Kukatpally is influenced by various factors including economic dynamics, infrastructure developments and changing market trends. Understanding the insights provided by property advisors regarding property rates in Kukatpally is crucial for individuals interested in investing or buying properties in this area.

Unveil the 50-50 payment plan

- Market Analysis and Trends: Property advisors specializing in Kukatpally provide a comprehensive market analysis, offering insights into the recent trends shaping the real estate landscape. They track property rates, demand supply dynamics and buyer preferences providing a holistic view of the market scenario.

- Factors Influencing Property Rates: Advisors highlight the factors influencing property rates in Kukatpally such as proximity to commercial hubs, infrastructural developments like metro connectivity, educational institutions, improved road networks, amenities and the overall growth potential of the locality. They assess how these factors impact property prices in different segments.

- Demand for Residential and Commercial Spaces: Property advisors share their observations on the demand for residential and commercial spaces in Kukatpally. They analyse the preferences of homebuyers and businesses, providing insights into the type of properties experiencing higher demand and potential investment opportunities.

- Future Projections and Investment Potential: Based on their market analysis, property advisors offer insights into the future projections of property rates in Kukatpally. They discuss the investment potential of different properties helping potential buyers and investors make informed decisions.

Market Dynamics: How Inflation Shapes Hyderabad’s Real Estate Scenario

Hyderabad can be tricky for home buying considering how prices change. Inflation, when things get more expensive over time has a big impact on how much homes cost. Let’s explore how inflation affects the prices of homes in Hyderabad. We’ll see how different things happening in the economy make house prices go up or down and how this affects people looking to buy or sell homes in the city.

- Price Changes: Inflation causes the prices of construction materials and land to increase, directly affecting the cost of building homes. Consequently this drives up the prices of houses in Hyderabad.

- Limited Construction: Inflation can slow down the construction of new homes as builders face higher expenses. This shortage of new homes can push prices higher due to less supply in the market.

- Demand Supply Imbalance: In areas with high demand but low supply, inflation may cause prices to rise more sharply making it challenging for buyers to find affordable homes.

- Loan Conditions: Inflation influences bank interest rates, making it harder for people to get affordable loans for buying homes when prices increase.

Factors Driving Property Prices in Hyderabad

Market Dynamics: Impact of Inflation on Hyderabad’s Property Rates and Trends

Hyderabad’s real estate market is constantly evolving, influenced significantly by the effects of inflation on property rates. Inflation plays a pivotal role in shaping the dynamics of real estate in the city. This exploration aims to dissect how inflation impacts property rates in Hyderabad, shedding light on market trends, fluctuations and the interplay of economic forces affecting real estate prices.

- Price Fluctuations: Inflation triggers cost escalations in construction materials and land, leading to increased property rates. This rise in expenses directly influences the pricing of homes and properties across Hyderabad.

- Supply Challenges: Inflationary pressures can hinder the construction of new properties, creating a scarcity in supply. This shortage of available homes could contribute to an upsurge in property prices.

- Financial Considerations: Inflation often impacts interest rates on loans, affecting the accessibility of mortgages. Elevated rates may deter potential buyers, affecting their purchasing power and subsequently, property prices.

- Seller Strategies: Sellers might hold off on selling their properties, anticipating further price increases driven by inflation, thereby reducing available properties in the market.

Real Estate Prices in Hyderabad: Fluctuations and Analysis during Inflationary Periods

- Economic Indicators: During inflationary periods, economic indicators such as interest rates on loans and mortgage availability fluctuate. These financial factors influence buyers’ affordability and consequently affect property values.

- Regional Variances: Property values in Hyderabad can fluctuate differently in various regions based on factors like infrastructure development, proximity to commercial hubs and urban expansion, among others.

- Buyer Considerations: Inflation induced increases in property values might pose challenges for prospective buyers, impacting their ability to afford homes in preferred areas.

Property Advisor Hyderabad Observations on Market Changes due to Inflation

Closely monitoring Hyderabad’s real estate scene and understanding the market value of properties is integral especially during periods of inflation.

- Urban Development Impact: Infrastructural advancements and urban expansion projects in certain areas can influence the market value of properties, both positively and negatively during inflationary periods.

- Investment Insights: Providing diversified investment suggestions beyond real estate could be essential for clients considering shifting market values influenced by inflation.

- Inflationary Influence: Inflation triggers a rise in costs associated with property development, including construction materials, land acquisition and operational expenses. This leads to an escalation in the market value of properties across Hyderabad.

Inflation’s Effect on Home Buying Decision Making

Buying Behaviour Shifts: Impact of Inflation on Purchasing Decisions

Inflation significantly influences consumers’ buying behavior and purchasing decisions. Studying the patterns, behaviors and shifts that have been closely monitored over a span of years can ease the buyers’ mind.

- Price Sensitivity: When inflation occurs, prices of goods and services rise. This increase can make consumers more price sensitive, leading them to seek cheaper alternatives, economise on spending or delay non essential purchases.

- Shift in Preferences: Inflation can prompt consumers to re-evaluate their preferences. They may opt for lower priced substitutes or choose products that offer better value for money rather than sticking to brand loyalty.

- Delayed Purchases: High inflation rates may lead consumers to delay major purchases, especially for big ticket items like homes or vehicles. They might postpone these decisions until they feel more confident about their financial stability or until prices stabilise.

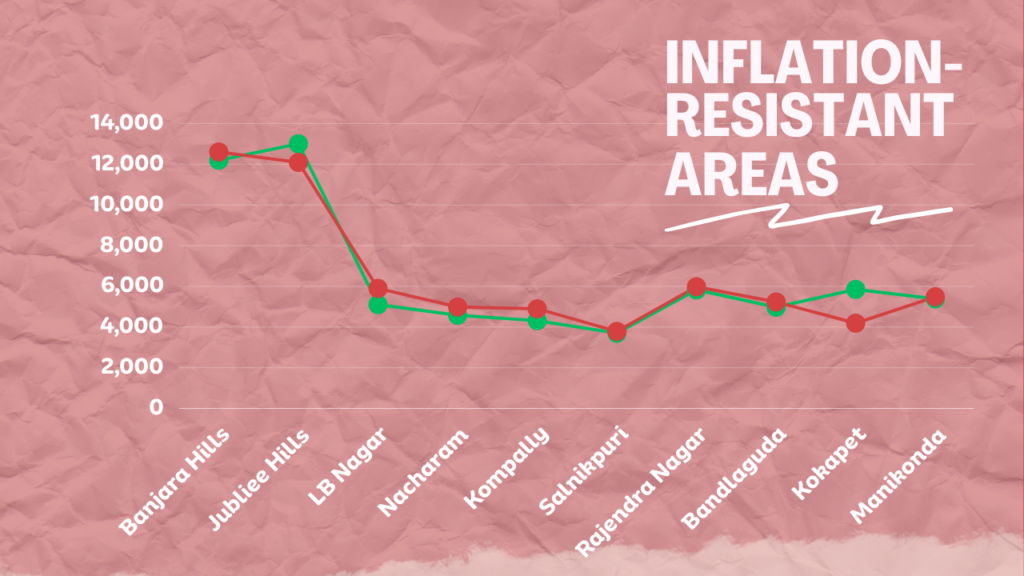

Hyderabad Real Estate: Inflation-Resistant Areas

Inflation-Resilient Areas: Gachibowli, Financial District, and Kokapet Analysis

When considering the inflation resilience of areas like Gachibowli, the Financial District, and Kokapet in Hyderabad’s real estate market, several factors contribute to their perceived stability.

- Economic Activity and Employment Centres: These areas host major IT parks, corporate offices, educational institutions and commercial establishments. The steady influx of jobs and economic activity tends to bolster the demand for real estate, potentially making these areas more resilient to inflation.

- Market Stability and Price Appreciation: Analysing how property prices have appreciated over time can provide insights. Locations showing steady price appreciation during inflationary periods may showcase resilience in the face of economic fluctuations.

- Diversification of Real Estate Offerings: Areas offering a mix of residential, commercial and retail spaces tend to attract a diverse range of investors and buyers. This diversity might offer some degree of protection against inflation induced market volatility.

- Quality of Life and Amenities: Areas with good quality living standards, recreational facilities, healthcare and educational institutions tend to maintain demand, making them more resilient to inflation induced market fluctuations.

- Rental Yield and Investor Interest: Steady rental yields and sustained investor interest despite inflationary periods can indicate the stability of these areas. Consistent demand from renters and investors showcases market resilience.

Property Rate Comparison during Inflation: Gachibowli, Financial District, and Kokapet

- Historical Price Trends: Analyse historical property price data for Gachibowli, the Financial District and Kokapet to understand their respective growth trajectories during previous inflationary periods. This data helps in assessing the relative resilience of these areas to inflation.

- Current Market Rates: Consult real estate platforms, databases or local agents to gather current property rate information in Gachibowli, the Financial District and Kokapet. Compare rates across property types (residential, commercial) and sizes (apartments, villas) within these localities.

Comparing property rates in Gachibowli, the Financial District and Kokapet during inflation necessitates a multifaceted analysis of various factors impacting the real estate market. Accessing specific data on property rates during inflationary periods might require consulting local real estate professionals or recent market reports for the most accurate and updated information.

Strategies for Investing Amidst Inflation: 3 BHK and 2 BHK Flats in Hyderabad

- Diversification of Portfolio: Consider diversifying your real estate portfolio by investing in both 3 BHK and 2 BHK flats. Diversification helps mitigate risk and caters to different segments of the market, potentially providing stability during inflation.

- Location Analysis: Research and select locations that have historically shown resilience in property values during inflation. Areas with consistent demand, good infrastructure and proximity to essential amenities tend to be more inflation-resistant.

- Rental Income Potential: Assess the rental income potential of both 3 BHK and 2 BHK flats. During inflation, rental properties can be a reliable source of income. Analyse rental yields in different areas of Hyderabad to maximize returns.

Budgeting and EMI Planning for 3 BHK and 2 BHK Flats in Hyderabad

- Establish Budget Limits: Define a realistic budget based on your financial assessment. Consider down payment capabilities, loan eligibility and monthly EMI affordability while setting budget limits.

- Consider Loan Options: Explore home loan options from financial institutions like banks or housing finance companies. Evaluate interest rates, loan tenure and eligibility criteria to choose the most suitable loan option.

- Factor in Down Payment: Calculate the down payment required for each property type. Ensure you have the necessary funds for the down payment, considering the loan to value ratio offered by lenders.

- Future Financial Planning: Consider future financial obligations, such as potential changes in income, expenses or additional investments while planning EMIs. Ensure flexibility in your budget for unforeseen expenses.

Financial District’s Influence on Home Prices: Pre-EMI Interest and Financial District Circle Analysis

The Financial District in Hyderabad has significantly influenced home prices due to various factors, including infrastructure development, employment opportunities and commercial growth. Here’s an analysis considering Pre-EMI interest and the Financial District circle’s impact on home prices:

- Employment Centers: The presence of major corporate offices, IT parks and multinational companies in the Financial District attracts a large workforce. This demand for housing close to workplaces can drive up property prices due to increased demand.

- Pre-EMI Interest Impact: Pre-EMI interest, which refers to the interest paid on the loan amount disbursed before the commencement of the actual EMI payment, can influence home prices. Homebuyers considering properties in the Financial District might factor in pre-EMI interest costs while evaluating affordability, potentially affecting pricing dynamics.

- Circle Rates and Market Trends: Circle rates, which are minimum property rates set by the government for a particular area, also play a role in determining home prices. The Financial District’s circle rates and their alignment with market trends can impact property pricing strategies.

Conclusion

In the dynamic landscape of Hyderabad’s real estate market, a multitude of factors interplay to shape property rates, investment prospects and financial decisions particularly amidst inflationary times. Analyzing areas such as the Financial District, Gachibowli and Kokapet reveals their resilience to inflation, driven by robust employment centres, infrastructure developments, and market demand.

In conclusion, Hyderabad’s real estate, notably areas like the Financial District, embodies promising investment prospects bolstered by economic resilience, commercial prominence and financial offerings. However, success in navigating these opportunities hinges on comprehensive market analysis, prudent financial planning, and a keen understanding of the ever evolving dynamics within Hyderabad’s real estate sector.