How to Save Tax on Rental Income in India (2025)

Rental Income Tax in India for 2025 is a key area of concern for property owners, especially in booming urban markets like Hyderabad, Mumbai, and Bengaluru. Whether you’re a local landlord, an NRI renting out a flat, or a real estate investor, understanding how rental income is taxed in India in 2025 can help you stay compliant and reduce your tax liability.

In this guide, we simplify the rules around rental income tax in India, deductions you can claim, TDS implications, and filing procedures.

- 1 What is Rental Income Tax in India?

- 2 How is Rental Income Tax Calculated in 2025?

- 3 What You Should Know About TDS on Property Income

- 4 Filing Rental Income Tax Returns in India 2025

- 5 What is DTAA?

- 6 Rental Income Tax Deductions in India

- 7 Common Mistakes in Tax Filing

- 8 Rental Income Tax Tips for Investors in 2025

- 9 FAQs

What is Rental Income Tax in India?

Rental income tax in India refers to the income tax charged on earnings from renting out a residential or commercial property. Under the Indian Income Tax Act, this type of income is classified under the head “Income from House Property”, regardless of whether the property is residential or commercial, or whether it is let out to individuals or businesses.

Even if you own multiple properties or receive rent from tenants informally, the income is taxable once it crosses basic exemption limits. It’s important to note that the rent itself is not taxed directly; instead, the law calculates a value known as the Net Annual Value (NAV) — which is then used to determine your taxable amount.

This taxation framework applies to both resident Indians and Non-Resident Indians (NRIs), with separate provisions for TDS (Tax Deducted at Source), deductions, and reporting procedures. Understanding how this income is calculated and what deductions are allowed can help reduce your overall tax liability.

How is Rental Income Tax Calculated in 2025?

We don’t tax the rent directly, but rather the Net Annual Value (NAV). Here’s a step-by-step breakdown to understand how rental income tax in India is calculated:

| Description | Amount (INR) |

| Annual Rent Received | ₹2,40,000 |

| Less: Municipal Taxes Paid | ₹10,000 |

| Net Annual Value (NAV) | ₹2,30,000 |

| Less: 30% Standard Deduction (Section 24a) | ₹69,000 |

| Less: Interest on Home Loan (Section 24b) | ₹1,50,000 |

| Taxable Income from Property | ₹11,000 |

Example: Renting Out a 3BHK Flat in Financial District, Hyderabad

Let’s say you own a 3BHK apartment (around 2,000–2,200 sq.ft) in a premium gated community located in Hyderabad’s Financial District or nearby IT hub areas like Gachibowli or Nanakramguda. You rent it out for ₹75,000 per month, which is the typical market rate for spacious, well-located apartments in this region.

| Description | Amount (INR) |

| Monthly Rent Received | ₹75,000 |

| Annual Rent Received | ₹9,00,000 |

| Less: Municipal Taxes Paid | ₹15,000 |

| Net Annual Value (NAV) | ₹8,85,000 |

| Less: 30% Standard Deduction | ₹2,65,500 |

| Less: Interest on Home Loan | ₹3,00,000 |

| Taxable Income | ₹3,19,500 |

What You Should Know About TDS on Property Income

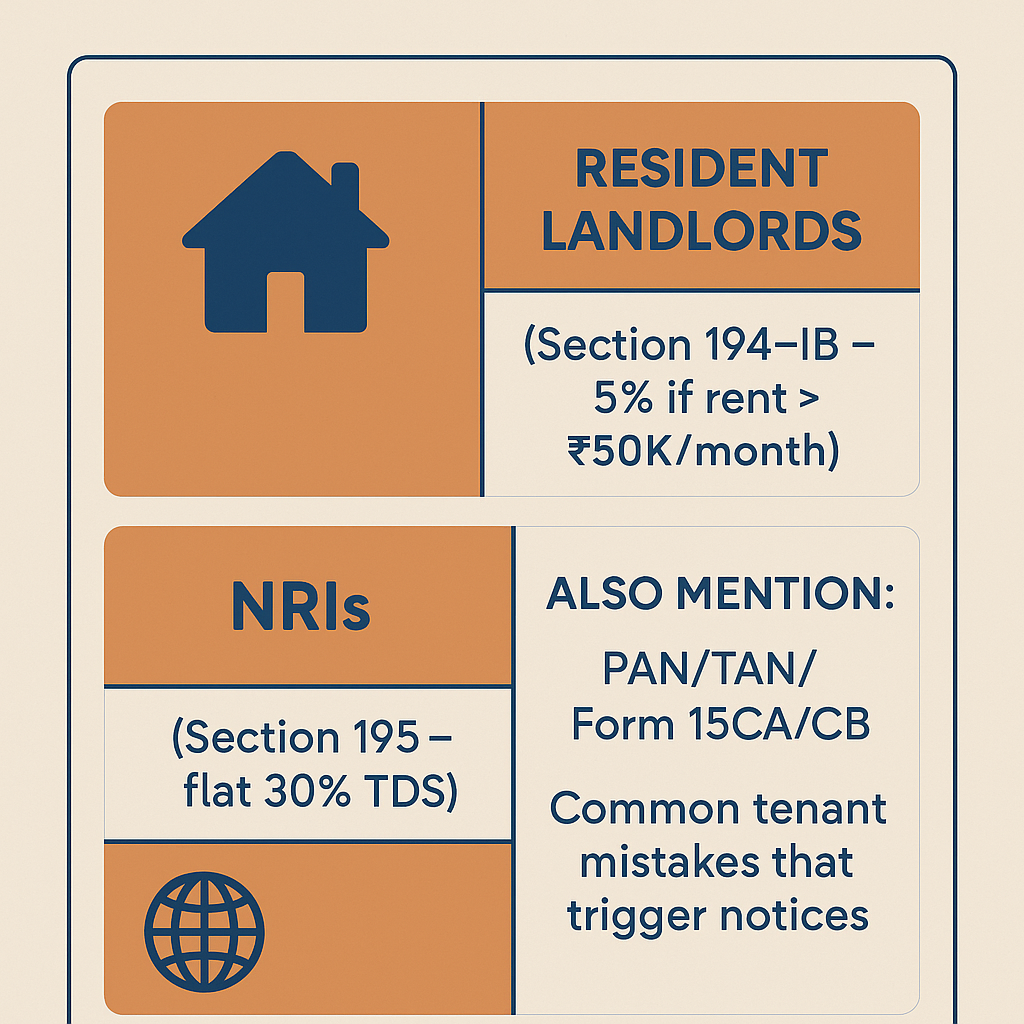

Whether you’re a tenant paying rent or a landlord receiving it, TDS (Tax Deducted at Source) rules apply differently depending on residency status. Tenants are responsible for deducting TDS before paying rent, and failure to comply can lead to penalties — especially when paying rent to an NRI. Here’s how TDS works for different scenarios:

- Resident landlords (Section 194-IB – 5% if rent > ₹50K/month)

- NRIs (Section 195 – flat 30% TDS)

Important Compliance Documents You Shouldn’t Miss:

While understanding rental income tax, it’s also important to know the legal and documentation requirements — especially when paying or receiving rent across borders. Below are some key documents involved in TDS compliance, particularly for NRIs: –

- PAN– A unique tax ID for all Indian taxpayers. Landlords must provide this to tenants for TDS

- TAN– Tenants paying rent to NRIs need this to legally deduct 30% TDS under Section 195.

- Form 15CA– An online form tenants must file before sending rent abroad to an NRI.

- 15CB– A CA certificate confirming correct TDS was applied before remitting funds overseas.

- Common tenant mistakes that trigger notices

Filing Rental Income Tax Returns in India 2025

Which ITR Should You File for Rental Income?

Choosing the correct ITR form is essential for proper reporting of rental income. The wrong form can lead to errors, notices, or even penalties. Here’s how to choose between ITR-1 and ITR-2:

- ITR-1-Used by resident individuals with salary, pension, or one house property (not let out to NRIs). Not for NRIs or those with multiple/rented properties.

- ITR-2-Used when you have rental income, especially from more than one property or if you’re an NRI. Ideal for landlords, investors, and global income disclosure

- What documents are needed: PAN, Form 26AS, Rent Agreement, etc.

What is DTAA?

DTAA (Double Taxation Avoidance Agreement) is a tax treaty India signs with other countries to ensure that NRIs don’t pay tax twice on the same income, such as rent earned in India and taxed abroad. To claim this benefit, NRIs must file Form 67 on the Income Tax portal before or along with their ITR. This form allows them to claim credit for foreign taxes paid and is a key requirement to avail DTAA relief.

Benefits on Rental Income for NRIs

In addition to tax relief through DTAA, NRIs can also enjoy other financial advantages. Rental income earned in India is fully repatriable after tax compliance, making it a reliable source of passive income. NRIs can claim unlimited interest deduction on home loans for let-out properties, and no GST is charged on residential rent. With proper planning, rental income can be a tax-efficient and stable investment tool for NRIs managing cross-border finances.

Supporting documents needed:

If you’re claiming DTAA benefits as an NRI, you’ll need to submit a few essential documents. These prove your residency status and the taxes paid abroad, ensuring you can legally claim tax credit in India:

- A. Tax Residency Certificate (TRC) – issued by the foreign country you live in — proves you’re a resident there and eligible for DTAA benefits.

- B. Proof of foreign tax paid

4. Common Mistake: Missing Form 67 deadline.

Rental Income Tax Deductions in India

Once you’ve calculated your Net Annual Value (NAV), you can reduce your taxable income by claiming deductions. Here’s a quick overview of what deductions are available to landlords under Indian tax law: –

- 30% Standard Deduction (Section (24a)

- Interest on housing loan (Section 24b) – No upper limit for let-out property

- Municipal taxes paid during the year

- Section 80C deduction if repaying home loan principal

Common Mistakes in Tax Filing

Many landlords, especially first-time filers or NRIs, end up making avoidable mistakes that lead to delayed refunds, notices, or penalties. Here’s what you should watch out for: –

- Not deducting or paying TDS on time (especially tenants paying NRIs)

- Using ITR-1 when ITR-2 is applicable

- Not submitting Form Form 15CA/15CB

- Ignoring municipal tax receipts and loan interest certificates

- Not maintaining a proper document folder

Rental Income Tax Tips for Investors in 2025

If you’re a long-term property investor or landlord, the right tax planning can significantly reduce your liability. These practical tips can help you save more and avoid future tax hassles: –

- Go for joint ownership to split rental income and reduce tax burden

- Consider investing in commercial spaces – different valuation and benefits

- Maintain updated documents like:

- Loan statements

- Rent agreements

- Form 26AS

FAQs

Yes, if you’re a resident Indian, global income is taxable. Report under Schedule FSI & FA.

Tenants still need to deduct TDS if monthly rent exceeds ₹50,000, regardless of your tax liability.

NRIs can still face penalties. Tenants are legally responsible for TDS Compliance.

Submit Form 67, TRC, and foreign tax proof to claim FTC.