How to Buy an Apartment: Self-Funding or Home Loan?

Deciding to buy an apartment is a big deal, and there’s a lot to think about. One of the biggest choices you’ll face is how to pay for it. Should you use your own savings, or go for a home loan?

Each option has its upsides and downsides. Paying with your own money means you have full control and no monthly mortgage to worry about. But saving up for a down payment can be tough, and the interest rates might not be great.

A home loan can get you into that apartment faster, and you might snag a lower interest rate. But, of course, you’ll have to handle those monthly mortgage bills and possibly some extra fees.

So, which way to go? It really hinges on your unique situation. If you’ve got the cash saved and are cool with monthly payments, self-funding could be your best bet. But if you need to borrow or want more financial flexibility, a home loan might suit you better.

PROS OF SELF-FUNDING A HOUSE

- Lower Total Cost: When you take out a loan to purchase a home, you could end up paying nearly 130% more than the actual property cost over a 20-year loan period. However, if you can finance the house yourself, you can eliminate this extra expense entirely.

- Simplicity: Paying for your home upfront leads to a simpler process. You won’t have to wait for loan approval or disbursement, making the entire home-buying experience hassle-free.

ADVANTAGES OF OPTING FOR A HOME LOAN TO BUY AN APARTMENT

appreciates with time, and property is one such asset. Home loans help you purchase a property with easy repayment plans, making it easier for you to own a home while also investing in an asset that could appreciate in the future, helping you earn higher returns on this investment.

One of the major benefits of availing a home loan is that you can ask your lender for a top-up loan during an emergency or when you are in need of financial aid. You can also avail tax benefits on a top-up loan under Sections 24 and 80C. A top-up loan can be used for various purposes like:

- Funding Children’s Education,

- Consolidation of Debts,

- Marriage,

- Renovating your property, etc

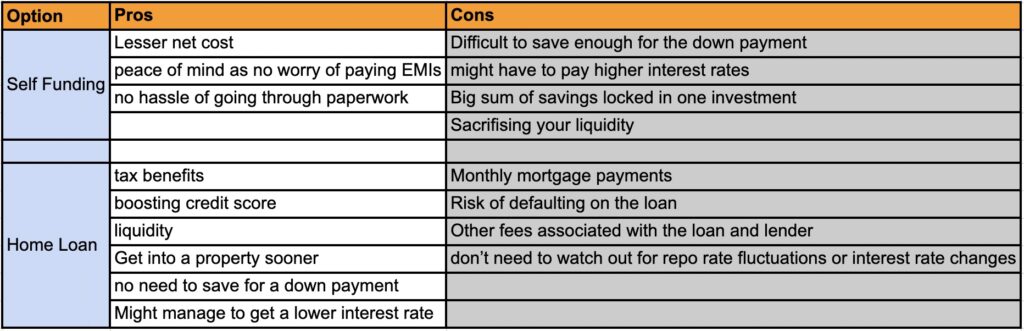

Here is a table that summarises the pros and cons of each option:

Advantages of Choosing a Home Loan to buy an apartment

Now that we’ve covered the benefits of paying for a house on your own, let’s take a look at the advantages of going for a home loan to buy your dream home:

- Tax Benefits: Opting for a home loan can bring tax advantages under India’s Income Tax Act, Section 80C. You can claim up to ₹1,50,000 in deductions and also get an additional deduction on the interest component for up to ₹2,00,000. This is a big reason why many people prefer home loans for home buying.

- Continued Tax Benefits: You might not be aware that you can still enjoy tax benefits even if you already have an existing housing loan. These benefits can be claimed for as long as you are repaying the loan. Section 24: Under this section, you can claim interest deductions for as long as you are repaying the loan, with a maximum deduction of INR 2 lakhs for self-occupied properties. Section 80C: Tax deductions under Section 80C are limited to INR 1.5 lakhs per year, and you can also avail of home loan top-up benefits on the principal loan amount.

- Improved Credit Score: Timely EMI payments boost your credit score, enhancing your creditworthiness over time.

- Preserved Liquidity: When you spend all your savings on buying a house without a loan, you may compromise your financial flexibility. This could be problematic in case of sudden financial emergencies.

- Asset Building: Property values tend to appreciate over time, and real estate is a prime example of this. Home loans offer manageable repayment plans, allowing you to own a home while investing in an asset that has the potential to grow in value, potentially yielding higher returns in the future.

In the end, the smartest move to figure out the best choice for you is having a chat with a financial advisor. They can look at your personal situation and help you make the right call for your money.

Here are a few more things to think about while you’re deciding:

- Your income and debt to income ratio

- Your credit score

- How much you’ll probably have to pay each month for your housing

- What you want to achieve with your money in the long run

Once you’ve considered all of these factors, you can make an informed decision about which option is best for you.

Check out our projects ASBL Spire, ASBL Springs, ASBL Spectra and the newest ASBL Loft

The ideal home loan amount depends on your financial situation. It’s generally recommended not to exceed 30-40% of your monthly income in loan repayments. This ensures you can manage other expenses comfortably.

Avoid taking a loan if you’re not financially stable or if it will stretch your budget to the limit. It’s also wise to refrain from loans if you have high-interest debts to pay off first.

Deciding between reducing the loan tenure or the EMI depends on your financial goals. If you want to become debt-free sooner and can afford higher EMIs, reducing the tenure is better. If you need flexibility in your monthly budget, you can opt for a longer tenure with lower EMIs, but it might result in higher interest payments over time.